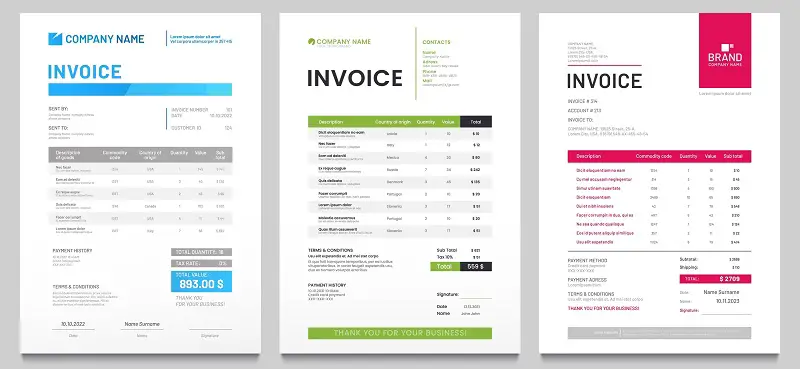

Crafting a business invoice is a crucial task for maintaining clear communication with clients and ensuring timely payments.

A well-structured invoice keeps your financial records organized and contributes to healthy cash flow. Invoicing may seem straightforward, but there are essential elements that need to be included for it to serve its purpose effectively.

Keep reading to learn the essential elements every business invoice should include.

1. Include Clear Business and Client Information

Including clear business and client information in your invoice is vital for avoiding confusion and ensuring smooth communication. Accurate details about both parties help establish accountability and reduce delays in payment.

To maintain clarity and professionalism, here are the key elements to include when outlining business and client information:

- Business name and logo: Display your business name prominently and include your logo. This adds a professional touch and reinforces your brand identity.

- Client’s information: Provide your client’s full business name along with their contact details, such as phone number, email, and mailing address. This ensures the invoice reaches the right person.

- Business information: Include your own contact details, such as business name, phone number, email, and, if relevant, your business registration number.

Accurately including this information builds trust and reduces the chance of payment errors. Using an invoice generator can further simplify this process, helping you create consistent and professional invoices effortlessly. Using these tools ensures all necessary details are included while also saving you time on manual data entry.

2. Provide a Detailed List of Services or Products

Providing a detailed breakdown of the services or products listed in your invoice is crucial for transparency. This ensures your client understands exactly what they’re being charged for, reducing the chances of disputes or delays.

Here are the elements to include when detailing services or products:

- Line items: Each service or product should be listed separately, with a clear description of what was provided. This avoids confusion and allows the client to see each item at a glance.

- Hourly rate or quantity: For services, specify the hourly rate and the total number of hours worked. For products, clearly state the quantity sold to ensure accuracy.

- Unit Price and total cost: Include the price for each service or product and the total cost per item. This helps the client understand how the final amount was calculated.

- Additional charges: If applicable, list any extra costs such as taxes, shipping fees, or service charges to maintain clarity.

A well-organized, detailed invoice helps build trust and professionalism, ensuring a smooth transaction process.

3. Assign a Unique Invoice Number and Date

Organizing invoices properly ensures smoother transactions, and assigning a unique invoice number with the date of issue is crucial for keeping track of payments. It helps avoid confusion, simplifies payment follow-ups, and keeps records organized. This aspect of invoicing can also play a role in your business strategy.

To ensure clarity and efficiency, include the following:

- Unique invoice number: Assign a specific number to each invoice to maintain order and easily reference past transactions. A sequential or systematic approach works best to prevent overlap or missed entries.

- Invoice date: This date marks when the invoice was generated. It’s important for establishing the timeline for payment and any potential follow-ups.

- Payment due date: Clearly indicate when payment is expected, based on your agreement with the client. This helps set expectations and encourages timely payments.

- Purchase order number: If applicable, include the client’s purchase order number to match the invoice with their internal processes.

Incorporating these elements into your invoice helps keep transactions clear, making it easier to manage both pending and completed payments.

4. Specify Payment Terms and Instructions

The last crucial element of an invoice is the clear explanation of payment instructions. This section should provide your client with all the necessary details they need to complete the payment.

Below are the key details to include when specifying payment terms and instructions:

- Accepted payment methods: List all available payment options, such as bank transfers, credit cards, or checks, so the client knows how they can settle the invoice.

- Bank account details: If bank transfers are an option, provide the account number, routing number, and any additional necessary banking information for accuracy.

- Payment terms: Clearly outline the payment due date and any potential incentives for early payment, such as discounts, or fees for late payment.

- Late payment penalties: State any penalties or fees for overdue payments, ensuring your client understands the consequences of missing the payment deadline.

Providing clear and concise payment details not only helps you get paid faster but also eliminates unnecessary back-and-forth communication. You can use a free invoice template or online invoicing software to ensure that all the important details are included without any omissions.

Final Thoughts

A well-crafted invoice reflects your professionalism and helps establish a solid relationship with your clients. Ensuring clarity in communication and providing essential details fosters trust and streamlines the payment process. Taking the time to create a comprehensive invoice enhances your cash flow and minimizes disputes and confusion.